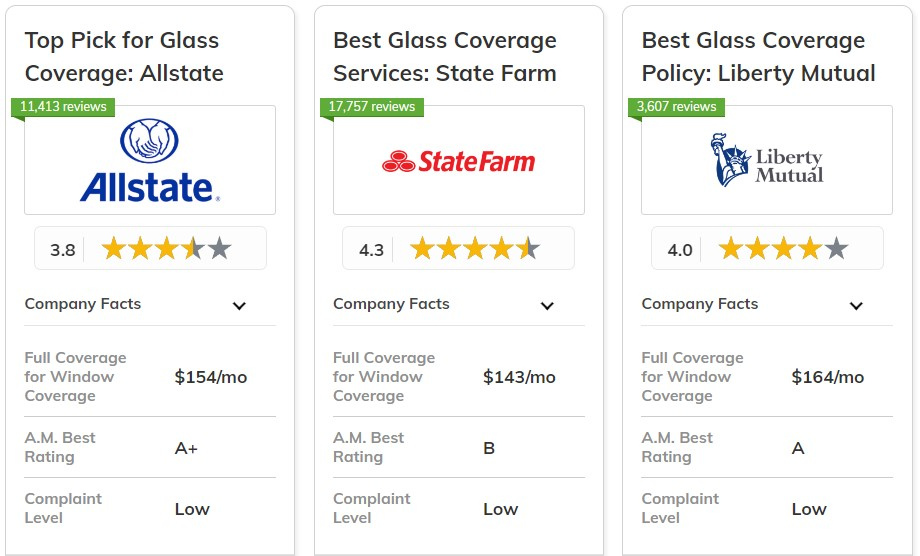

The top pick overall of the best car insurance companies that cover car windows are Allstate, State Farm, and Liberty Mutual, offering rates as low as $50/month.

Allstate stands out for its comprehensive coverage, State Farm for reliable service, and Liberty Mutual for flexible policies. Whether you need basic protection or full coverage, these providers deliver excellent options for car windows.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #2 | 17% | B | Reliable Service | State Farm | |

|

#3 | 25% | A | Flexible Policies | Liberty Mutual |

| #4 | 10% | A++ | Military Support | USAA | |

|

#5 | 20% | A+ | Trusted Reputation | Nationwide |

| #6 | 25% | A++ | Affordable Rates | Geico | |

| #7 | 10% | A+ | Customizable Options | Progressive | |

| #8 | 20% | A | Personalized Service | Farmers | |

| #9 | 13% | A++ | Consistent Quality | Travelers | |

| #10 | A | 0.15 | Policy Bundles | Safeco |

Learn how to get cheap car insurance from companies that cover car windows and discover when to file a broken car window insurance claim. Plus, comparing quotes can help you secure the most affordable rate for your vehicle.

Take the first step toward cheaper car insurance rates. Enter your ZIP code above to see how much you could save.

What You Should Know

- Explore the best car insurance companies that cover car windows starting at $50/month

- Allstate is the top pick for comprehensive window coverage

- Comprehensive or collision coverage protects against window damage or replacement

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Car Window Coverage: Allstate Car Insurance Company includes reliable coverage for car windows under its comprehensive plans.

- Low Minimum Coverage Rates: Rates start at $60/month for basic coverage, including protection for car windows.

- Bundling Discount: Allstate offers up to 25% off when bundling policies, which can help lower costs on car window coverage.

Cons

- Limited Glass Add-ons: Specialized car window and windshield coverage options are limited.

- Higher Premiums for Extras: Adding windshield and car window replacement coverage raises premiums.

#2 – State Farm: Best for Reliable Service

Pros

- Reliable Window Protection: State Farm Car Insurance Company offers dependable coverage for car windows, ensuring protection in case of damage.

- Affordable Minimum Coverage: Rates start at $54/month for minimum coverage, which includes car window protection.

- Policy Bundling Savings: Bundling policies provides solid discounts, reducing costs for car window coverage.

Cons

- Higher Glass Deductibles: Car window repair may come with higher deductibles compared to other insurers.

- Limited Windshield Add-ons: Options for specialized windshield and car window coverage are fewer.

#3 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Window Coverage: Liberty Mutual Car Insurance Company provides flexible options for car window protection under its comprehensive plans.

- Low Minimum Coverage Rates: Starting at $65/month for basic coverage, including car window protection.

- Bundling Discount: Liberty Mutual offers a 25% discount for bundling, helping to save on car window coverage.

Cons

- Higher Premiums for Glass: Enhanced car window and glass coverage can increase premiums.

- Discounts Vary by State: Not all bundling discounts for car window coverage are available in every state.

#4 – USAA: Best for Military Support

Pros

- Military-Focused Window Coverage: USAA Car Insurance Company offers excellent protection for car windows, specifically designed for military families.

- Affordable Minimum Coverage: Starting at $50/month for basic coverage, including car windows.

- Additional Glass Coverage: Partners with Safelite for windshield repair and replacement, offering extra coverage for car windows.

Cons

- Military-Exclusive: USAA is only available to military personnel and their families, limiting access to its car window coverage.

- Higher Deductibles in Some Areas: Glass and car window coverage deductibles can vary depending on location.

#5 – Nationwide: Best for Trusted Reputation

Pros

- Trusted Car Window Coverage: Nationwide Car Insurance Company offers reliable car window protection as part of its comprehensive plans.

- Competitive Minimum Rates: Starting at $61/month for minimum coverage, which includes protection for car windows.

- Bundling Discounts: Up to 20% savings when bundling policies, making car window coverage more affordable.

Cons

- Higher Deductibles for Glass: Car window repairs may come with higher deductibles.

- Slower Claims Process: Some reports indicate a slower claims process for car window and glass repairs.

#6 – Geico: Best for Affordable Rates

Pros

- Affordable Car Window Coverage: Geico provides low-cost options for protecting car windows.

- Low Minimum Rates: Starting at $55/month for basic coverage, including car window protection.

- Bundling Discount: Geico offers up to 25% off for bundling, which helps reduce car window coverage costs.

Cons

- Limited Glass Repair Access: Some regions may have limited access to Geico’s car window and glass repair partners.

- Premium Increases With Add-ons: Adding car window and windshield coverage can raise premiums.

#7 – Progressive: Best for Customizable Options

Pros

- Customizable Car Window Coverage: Progressive Car Insurance Company allows flexible customization for car window protection based on your needs.

- Affordable Minimum Coverage: Starting at $62/month for minimum coverage, including protection for car windows.

- Bundling Discount: Progressive offers a 10% discount for bundling policies, which can help lower the cost of car window coverage.

Cons

- Higher Glass Deductibles: Deductibles for car window repairs may be higher than competitors.

- Lower Bundling Savings: Bundling discounts for car window coverage are smaller compared to other insurers.

#8 – Farmers: Best for Personalized Service

Pros

- Personalized Car Window Coverage: Farmers Car Insurance Company offers personalized service and flexible options for car window protection.

- Competitive Minimum Coverage: Rates start at $66/month for basic coverage, including car window protection.

- Bundling Discount: Farmers provides a 20% discount for bundling, helping to reduce car window coverage costs.

Cons

- High Premiums for Glass Add-ons: Enhanced car window and glass coverage can raise premiums significantly.

- Less Flexible Deductibles: Car window coverage deductibles may not be as flexible as with some competitors.

#9 – Travelers: Best for Consistent Quality

Pros

- Consistent Car Window Coverage: Travelers Car Insurance Company offers reliable protection for car windows under its comprehensive plans.

- Low Minimum Coverage Rates: Starting at $63/month for minimum coverage, which includes car window protection.

- Bundling Discount: Travelers offers up to 13% savings when bundling policies, making car window coverage more affordable.

Cons

- Limited Glass Coverage in Some Areas: Availability of car window coverage may vary by location.

- Higher Premiums for Enhanced Coverage: Premiums may increase with higher levels of car window protection.

#10 – Safeco: Best for Policy Bundles

Pros

- Strong Car Window Coverage: Safeco provides comprehensive coverage for car windows, ensuring protection in various situations.

- Affordable Minimum Coverage: Rates start at $64/month for basic coverage, including car window protection.

- Bundling Discount: Up to 15% off when bundling policies, helping to save on car window coverage.

Cons

- Higher Deductibles for Glass: Windshield and car window replacement may come with higher deductibles.

- Limited Customization Options: Car window coverage options may not be as customizable as with other providers.

Affordable Rates From Car Insurance Companies That Cover Car Windows

You may be wondering, does car insurance cover broken windows? Fortunately, there are many affordable car insurance companies that cover car windows. But how well you're covered depends on what type of insurance you carry and how the window broke.

Below, compare the monthly full coverage and minimum coverage insurance rates from the top providers to help you determine the best car insurance company that covers car windows for you:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $60 | $154 | |

| $66 | $165 | |

| $55 | $145 | |

|

$65 | $164 |

|

$61 | $155 |

| $62 | $156 | |

| $64 | $158 | |

| $54 | $143 | |

| $63 | $157 | |

| $50 | $135 |

A basic policy usually does not replace broken windows. But full coverage insurance often does.

Luckily, there aren’t really any affordable car insurance companies that don't cover car windows. But our top recommended providers for window coverage include USAA and Geico.

USAA is only available for military personnel and their families. But if you qualify, USAA offers some of the lowest rates throughout the country.

The company also partners with Safelite and offers additional windshield repair and replacement glass coverage through the USAA Auto Glass Network.

Plus, if the windshield can be repaired rather than replaced, USAA waives your comprehensive insurance deductible.

You can also invest in Geico full glass coverage. Geico is available to any driver and often provides competitively priced quotes comparable to USAA.

Like USAA, Geico also waives your comprehensive insurance deductible if the windshield can be repaired rather than entirely replaced.

Learn more:

Similarly, State Farm windshield coverage is another strong option. The provider partners with LYNX Services for the glass repair.

However, your deductible may apply even for simple maintenance.

At the end of the day, not every insurance provider is active or available in every part of the country.

Plus, many different variables impact your individual car insurance rates, including your age, ZIP code, coverage needs, and driving record.

So the best way to buy car insurance from companies that cover car windows is to comparison shop online.

When Car Insurance Covers Your Car Windows

Drivers often wonder, does car insurance cover a broken window? Technically, only certain types of insurance cover car windows.

So, to find out, check the details of your policy.

For example, the liability insurance commonly required by state laws does not cover damage to your own vehicle.

It only pays for the damage to another driver if you cause an accident.

If you just want basic liability coverage or your state’s minimum insurance requirements, then you’ll only get car insurance quotes from companies that don't cover car windows.

For coverages that pay for repairs to your vehicle, you’ll need to purchase comprehensive or collision insurance.

You can compare the average cost of comprehensive and collision insurance by the state in the table below.

| State | Collision Insurance Monthly Rates | Comprehensive Insurance Monthly Rates |

|---|---|---|

| Alabama | $26 | $13 |

| Alaska | $29 | $11 |

| Arizona | $23 | $16 |

| Arkansas | $27 | $16 |

| California | $33 | $8 |

| Colorado | $24 | $15 |

| Connecticut | $31 | $11 |

| Delaware | $27 | $12 |

| Florida | $24 | $19 |

| Georgia | $28 | $10 |

| Hawaii | $26 | $13 |

| Idaho | $18 | $8 |

| Illinois | $26 | $10 |

| Indiana | $21 | $11 |

| Iowa | $18 | $10 |

| Kansas | $22 | $15 |

| Kentucky | $22 | $22 |

| Louisiana | $35 | $12 |

| Maine | $22 | $18 |

| Maryland | $29 | $9 |

| Massachusetts | $32 | $13 |

| Michigan | $34 | $11 |

| Minnesota | $20 | $13 |

| Mississippi | $27 | $15 |

| Missouri | $23 | $18 |

| Montana | $22 | $15 |

| Nebraska | $20 | $18 |

| Nevada | $25 | $19 |

| New Hampshire | $26 | $10 |

| New Jersey | $32 | $9 |

| New Mexico | $23 | $11 |

| New York | $32 | $14 |

| North Carolina | $24 | $14 |

| North Dakota | $20 | $11 |

| Ohio | $22 | $19 |

| Oklahoma | $27 | $10 |

| Oregon | $19 | $19 |

| Pennsylvania | $27 | $8 |

| Rhode Island | $34 | $12 |

| South Carolina | $22 | $11 |

| South Dakota | $17 | $15 |

| Tennessee | $26 | $22 |

| Texas | $31 | $12 |

| Utah | $22 | $12 |

| Vermont | $25 | $9 |

| Virginia | $23 | $10 |

| Washington | $22 | $11 |

| Washington D.C. | $39 | $10 |

| West Virginia | $27 | $9 |

| Wisconsin | $19 | $17 |

| Wyoming | $23 | $11 |

| Countrywide | $27 | $21 |

But what does comprehensive and collision insurance cover? Comprehensive insurance is known as parked car insurance.

It covers damage to your vehicle while not in motion, including:

- Weather damage

- Animal damage

- Fires

- Flooding

- Vandalism

- Auto theft

Collision insurance covers damage to your vehicle while it’s in motion, including an accident with another driver or an object like a tree or telephone pole.

So if you use a car insurance company that doesn’t cover car windows, it may be because you do not have comprehensive or collision insurance.

Both collision and comprehensive coverage have deductibles associated with the policies.

Will you pay a deductible if you use your car insurance coverage for windshield damage? It may depend on the severity of the claim.

Through most providers, there’s a difference between repairing versus replacing your windshield. A total replacement may mean you use your insurance deductible.

But some providers waive your deductible if the windshield can simply be repaired.

Similarly, many national insurance companies offer additional windshield replacement or glass repair coverage separate from other insurance types.

How do I know if my insurance covers windshield replacement? You can ask your insurance representative, check the company website, or use your customer portal to see if your provider offers this service.

But read the fine print. Some providers actually do require additional glass coverage and will not replace your windows even if you have comprehensive and collision coverage.

Does car insurance cover a broken driver-side window? As long as you have comprehensive or collision insurance, your provider should replace a driver-side window.

Buying Additional Car Insurance Coverage

To determine if you should buy additional insurance coverages, consider your budget, insurance limits, and the value of your car.

People who rent or finance their vehicles may be required by their loan agreement to purchase full coverage car insurance.

If your car is worth more than $3,000, experts typically recommend adding both comprehensive and collision insurance to your policy if it fits your budget.

Increasing your deductibles leads to lower monthly rates, but be careful not to set them too high, or it mitigates the usefulness of the policies.

According to the Insurance Information Institute (III), in 2020, the average collision claim cost $3,588; comprehensive claims were slightly lower at $1,995.

But if your car is older and is not worth much, investing in comprehensive and collision coverage might not be necessary.

Who should invest in additional windshield coverage? Consider the cost of the add-on coverage compared to the risk of breaking your windshield.

As long as the annual cost of adding windshield coverage doesn’t exceed the possible expense of your windshield replacement or repair, then it’s worthwhile.

But how much does it cost to repair or replace a windshield? It varies based on the car make and model you drive, especially for complete replacement:

- Windshield repair: $120

- Windshield replacement: $300 to $900

We have two tips on what to do if you do not have comprehensive insurance but break your car window.

First, if another driver hit you and is at fault for the damage, verify if you live in a state where their liability coverage will pay for your window replacement.

Alternatively, if another person breaks your windshield and they have homeowners or renters insurance, you may be able to file a third-party claim against one of those policies.

But you’d be responsible for proving fault.

Ultimately, if you buy car insurance from companies that don't cover car windows to your satisfaction, then never hesitate to shop around for new coverage.

Just be sure to secure a new policy before canceling your old one to prevent a coverage lapse.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

Filing a Claim for Car Window Damage

| Insurance Company | Available Discount |

|---|---|

| Multi-policy discount, claim-free discount, home security system discount, occupational discount | |

| Multi-policy discount, smoke detector discount, sprinkler system discount, claim-free discount | |

| Multi-policy discount, early shopper discount, claim-free discount, paperless billing | |

|

Multi-policy discount, protective device discount, claims-free discount, paperless billing |

|

Multi-policy discount, paperless billing, quote in advance discount, new policyholder discount |

| Multi-policy discount, new home discount, protective devices discount, loyalty discount | |

| Multi-policy discount, home security discount, claim-free discount, automatic sprinkler discount | |

| Multi-policy discount, protective device discount, green home discount, claim-free discount | |

| Multi-policy discount, home security discount, loyalty discount, automatic payments | |

| Multi-policy discount, protective device discount, claims-free discount |

If you want to know how to file a claim after your windshield breaks, you’re in luck. Filing a claim for a broken window is the same as filing any other type of insurance claim.

Either call your provider directly or submit the claim online or through a mobile app.

But if another driver hit your car and is at fault, their liability coverage will likely pay for your window replacement.

In this case, you’d file a third-party claim through their insurance.

However, if the break was from an act of vandalism, call the police first and file a report.

Obtain a copy of the police report and submit it with your claim.

After calling, your provider may direct you to bring your vehicle to a repair shop, or it might use a specific glass repair company.

Save all of your receipts so your insurer can adequately reimburse you.

When should you file a broken windshield insurance claim? It depends on how damaged your windshield is and what your insurance limits are set at.

Most deductibles for comprehensive or collision coverage are between $50 to $2,000.

So, if your deductible is set at $1,000, the chances of your windshield replacement costing that much are slim.

In this scenario, it’s better to pay for the repair out of your pocket and not file a claim. But if the damage exceeds your deductible, then file the claim.

You might also wonder, will my insurance go up if I claim for a windshield?

Filing claims, even when you’re not at fault, sometimes do lead to a rate increase.

So never hesitate to ask your provider directly how this type of claim might impact your rates.

Case Studies: Uncover the Experiences of Car Insurance Companies Covering Car Windows

Let's explore how the top car insurance companies offer solutions for broken car windows through comprehensive coverage, reliable service, and flexible policies.

Case Study #1 - Comprehensive Coverage at Affordable Rates: A Florida driver used Allstate’s comprehensive coverage after debris broke their windshield. With a $50/month rate and minimal deductible, they quickly replaced the windshield with no hassle.

Case Study #2 - Reliable Service and Quick Repairs: A Texas driver with State Farm had their side window shattered. State Farm processed the claim within hours and arranged immediate repairs, ensuring a smooth experience.

Case Study #3 - Flexible Policies Tailored to Unique Needs: A California driver used Liberty Mutual’s full glass coverage to repair their rear window without out-of-pocket costs after tree damage, thanks to Liberty’s customizable policy.

These case studies highlight how the best car insurance companies that cover car windows, including Allstate, State Farm, and Liberty Mutual, provide affordable rates, quick service, and flexible policies to meet the diverse needs of drivers. When it comes to window damage, choosing the right provider can make all the difference.

Finding Car Insurance Companies That Cover Car Windows

Depending on how the damage happened, your insurance policy might cover car windows as long as you’ve invested in the right coverage types.

Each provider uses different rules and policies to determine when your windshield or windows are covered.

So don’t pay car insurance rates from companies that don't cover car windows to your satisfaction.

Instead, shop around and find a provider that fits your budget without compromising your coverage requirements.

Now that you’ve learned about car insurance rates from companies that cover car windows, enter your ZIP code into our free tool below to compare quotes from the best providers in your region.

Frequently Asked Questions

What types of insurance cover car windows?

Comprehensive and sometimes collision insurance cover car windows damaged by incidents like theft, weather, or accidents.

Does liability insurance cover broken car windows?

No, liability insurance only covers damages you cause to other vehicles or property. It does not cover your own car’s windows.

Can I add specific glass coverage to my insurance policy?

Yes, some insurers offer additional glass coverage as a rider or add-on to your comprehensive insurance, specifically for window repairs or replacements.

What’s the difference between glass repair and replacement coverage?

Glass repair coverage typically waives your deductible if the damage can be fixed without replacing the entire window, while replacement coverage often requires a deductible.

How much does it cost to repair or replace a car window?

The average cost to repair a windshield is around $120, while full replacement can range from $300 to $900, depending on the make and model of your car.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Should I file a claim for a broken car window?

If the cost to repair or replace the window exceeds your deductible, it’s worth filing a claim. For minor damages, paying out of pocket may be more cost-effective.

Will filing a claim for a broken window increase my insurance premium?

It depends on your insurer and policy. Some claims may result in a rate increase, while others, such as minor glass repairs, may not affect your premium.

How long does it take to repair or replace a car window?

Repairing a small crack or chip usually takes 30 minutes to an hour, while replacing a full window may take a couple of hours.

What should I do if my car window is broken due to vandalism?

Report the vandalism to the police and file a claim with your insurer. Many companies require a police report for claims involving criminal activity.

Can I choose my own repair shop for window repairs?

Most insurers allow you to choose a repair shop, but some may recommend or require specific approved repair networks for faster service and direct billing.